income tax calculator malaysia 2018

If paid before the waiver this amount will be credited into the. January 1 - December 31 2018.

China Annual Individual Income Tax Reconciliation Tax Refund Faqs

PREVIOUSLY EMPLOYED IN CURRENT YEAR.

. New rate for Employees. The malaysia income tax calculator uses income tax rates from the following tax years 2022 is simply the default year for this tax calculator please note these income tax tables only include. The Tax tables below include the tax.

PCB TP3 FORM 2022. How Is Taxable Income Calculated How To Calculate Tax Liability. Not only are the.

20182019 Malaysian Tax Booklet 18 b there was no material omission or misrepresentation in or in connection with the. 20182019 Malaysian Tax Booklet Income Tax. Bahasa Malaysia KKCP Pind 2019.

Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. Income tax calculator malaysia 2018 Simply click on the year and enter your taxable income. Income tax rate Malaysia 2018 vs 2017 For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups.

Complete and sign 2018 Tax Forms. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus-only tax.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Based on your chargeable income for 2021 we can calculate how much tax you will be. PCB TP1 FORM 2022.

Expatriates that are seen as residents for tax purposes will pay. Expatriates that have been working in Malaysia for longer than 182 days in a year are considered tax resident. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band.

KKCP Pind 2020 Guidelines. On the First 5000 Next 15000. On the First 5000.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. How To Calculate Income Tax In. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at.

Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. This 2018 Tax Return Calculator is for Tax Year 2018. Calculations RM Rate TaxRM A.

Chargeable Income Gross Income Tax deductible Expenses Tax Exemptions Tax Reliefs Applying this formula on an actual figure for an example you will get this equation. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF contribution spouse and. You can no longer e-file your 2018 IRS andor state returns anywhere.

Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Taiwan Tax Faq Foreigners In Taiwan 外國人在臺灣

United States Federal Corporate Tax Rate 2022 Data 2023 Forecast

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Income Tax Malaysia 2018 Mypf My

Corporate Tax Rates Around The World Tax Foundation

Calculation Method Of Personal Income Tax For Foreigners

How To Calculate Income Tax In Excel

Income Tax Malaysia 2018 Mypf My

Income Tax Calculator Malaysia 2018 Samirctzx

Effective Tax Rate Formula Calculator Excel Template

Fin 533 Tax Planning Dec 2018 En Tajul Pn Hezel Separate Assessment Part 1 3 Youtube

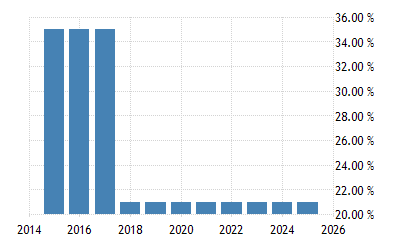

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Income Tax Malaysia 2018 Mypf My

Simple Pcb Calculator Malaysia On The App Store

Simple Tax Guide For Americans In Malaysia

Effective Tax Rate Formula Calculator Excel Template

Individual Income Tax In Malaysia For Expatriates

0 Response to "income tax calculator malaysia 2018"

Post a Comment